current projects

DISCOVER YOUR NEXT VENTURE

Embrace the power and safety of collective secured investments.

In the world of co-lending and syndication, property assets are one of the best ways to secure capital.

Our Co-Lenders own the controlling equity in a secured Deed of Trust. Co-Lending opportunities begin

at $100,000.

Our Subscribers benefit from the strength of numbers - diversified investors, pooled resources -- winning together. subscription options begin at $25,000.

Discover your next venture from the selection of available projects below. Choose 'Lend' or 'Subscribe' to explore the possibilities.

Offering closes within 30 days.

Offering closes within 30 days.

FAQs

What are your fees?

We charge no fees to our subscribers. All fees are paid by borrowers and all funding is secured by real estate and private equity.

What are your investment strategies?

We invest in secured commercial hard money real estate acquisition and development transactions. We also consider private equity value add opportunities secured at a minimum of 5 times EBITA.

How often will you communicate regarding performance with me?

We provide quarterly reports on all subscriptions as well as a final report at the time that any subscription position is exited.

Do I have to be an accredited investor to participate?

Unless exempted under the JOBS Act of 2012, you must be an accredited investor in order to participate in our subscription programs and you must sign a self-certification to this effect.

How does your subscription process work?

Our process is simple.

1) Review the PPM for the project that you're interested in and decide on the amount that you wish to subscribe to.

2) Complete the Project Subscription Form. Your subscription documents will be automatically generated and sent to your email for digital signature.

3) Once your documents are accepted and countersigned, fund within 3 business days or risk potential forfeiture of your position. You will receive email confirmation that your subscription is active within 24 hours of funding receipt.

Legal Notice:

Bridge Fund Development Group LP does not provide legal, tax, or investment advice. The information presented on this website is for informational purposes only and should not be construed as professional advice or a recommendation to engage in any specific investment strategy or transaction. Clients and prospective investors are strongly encouraged to consult with their own legal, tax, and financial advisors regarding their individual circumstances and the suitability of any investment or service.

All investments carry risk, and past performance is not indicative of future results. Offers to invest, where applicable, are made only pursuant to official offering documents and in accordance with applicable securities laws.

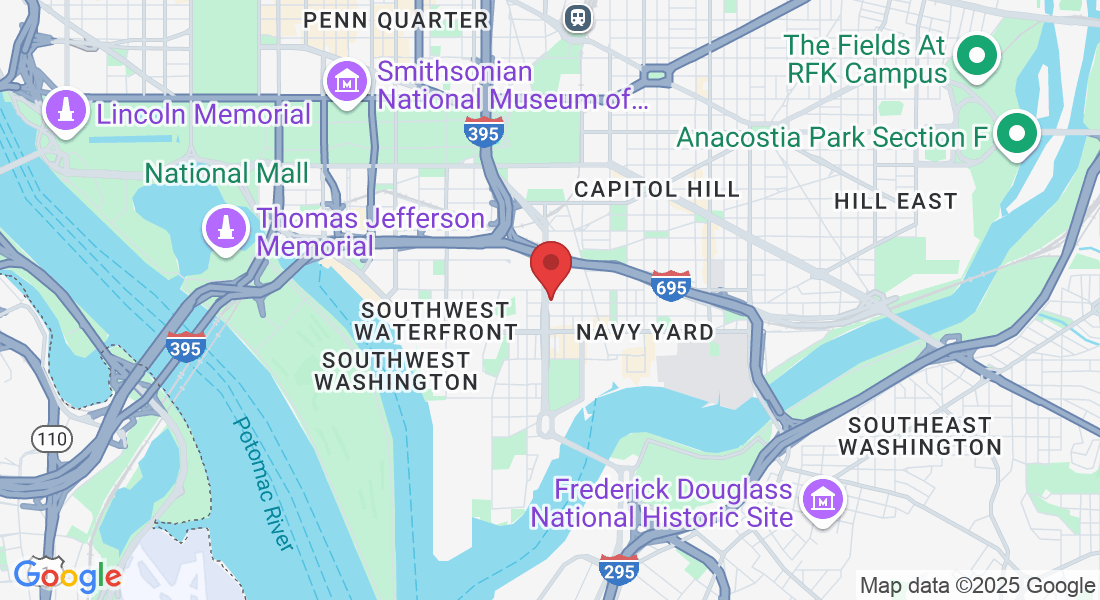

Bridge Fund Development Group LP is a Delaware limited partnership. For licensing details or regulatory inquiries, please contact us at [email protected] or by mail at10 K Street SE, Suite 1012 Washington, DC 20003.