Grow Your Wealth

Strategic Investments in Private Equity and Real Estate

About Us

BRIDGE FUND DEVELOPMENT GROUP LP

Bridge Fund Development Group LP provides strategic capital solutions for commercial real estate projects and private equity acquisitions. Our institutional approach to private lending delivers reliable financing for developers and returns for investors.

We offer a path to competitive returns through secured bridge loans for real estate and private equity projects. Our proven process aggregates capital while carefully managing every aspect of project underwriting in order to maximize value and security for fund participants.

Our Services

Fix-and-Flip Acquisition

and Working Capital

Profiting from real estate fix-and-flip projects requires more than just a great property; it requires substantial capital. Lenders typically require a significant down payment for acquisition, as well as reserves to cover critical expenses.

From the significant down payment required for acquisition to the working capital needed for construction, permits, and other soft costs, a project's success hinges on having the right resources.

Bridge Fund Development Group LP provides comprehensive financing solutions to cover these needs, empowering qualified professionals to execute more projects more efficiently.

Private Equity Acquisition and Value-Add Investments

As Baby Boomers retire with their children well established in other careers, a significant wealth of small and medium-sized businesses in America are becoming available for acquisition.

These well established enterprises are often valued at just 2.5-5x EBITDA, and can be a powerful source of passive income that readily outperforms traditional real estate.

We provide resources needed for profitable strategic acquisitions and value-add opportunities, facilitating ownership through debt and equity while leveraging new technologies and regulatory frameworks to increase profitability and business's value.

Retirement Income Annuity Alternatives*

With a single premium, clients gain a permanent life insurance policy that delivers guaranteed death benefits while providing a guaranteed dividend and building tax‑deferred cash value over time. Without future premiums, the coverage can never lapse.

Clients also access 70–90% of their cash value through, secured leverage without triggering a tax event. This dynamic structure combines stability, estate planning clarity, predictable returns, and liquidity—enabling you to deploy working capital independent of the policy while retaining full protection and tax advantages..

*Partner Provided

FAQs

What are your fees?

We charge no fees to our subscribers. All fees are paid by borrowers and all funding is secured by real estate and private equity.

What are your investment strategies?

We invest in secured commercial hard money real estate acquisition and development transactions. We also consider private equity value add opportunities secured at a minimum of 5 times EBITA.

How often will you communicate regarding performance with me?

We provide quarterly reports on all subscriptions as well as a final report at the time that any subscription position is exited.

Do I have to be an accredited investor to participate?

Unless exempted under the JOBS Act of 2012, you must be an accredited investor in order to participate in our subscription programs and you must sign a self-certification to this effect.

How does your subscription process work?

Our process is simple.

1) Review the PPM for the project that you're interested in and decide on the amount that you wish to subscribe to.

2) Complete the Project Subscription Form. Your subscription documents will be automatically generated and sent to your email for digital signature.

3) Once your documents are accepted and countersigned, fund within 3 business days or risk potential forfeiture of your position. You will receive email confirmation that your subscription is active within 24 hours of funding receipt.

Legal Notice:

Bridge Fund Development Group LP does not provide legal, tax, or investment advice. The information presented on this website is for informational purposes only and should not be construed as professional advice or a recommendation to engage in any specific investment strategy or transaction. Clients and prospective investors are strongly encouraged to consult with their own legal, tax, and financial advisors regarding their individual circumstances and the suitability of any investment or service.

All investments carry risk, and past performance is not indicative of future results. Offers to invest, where applicable, are made only pursuant to official offering documents and in accordance with applicable securities laws.

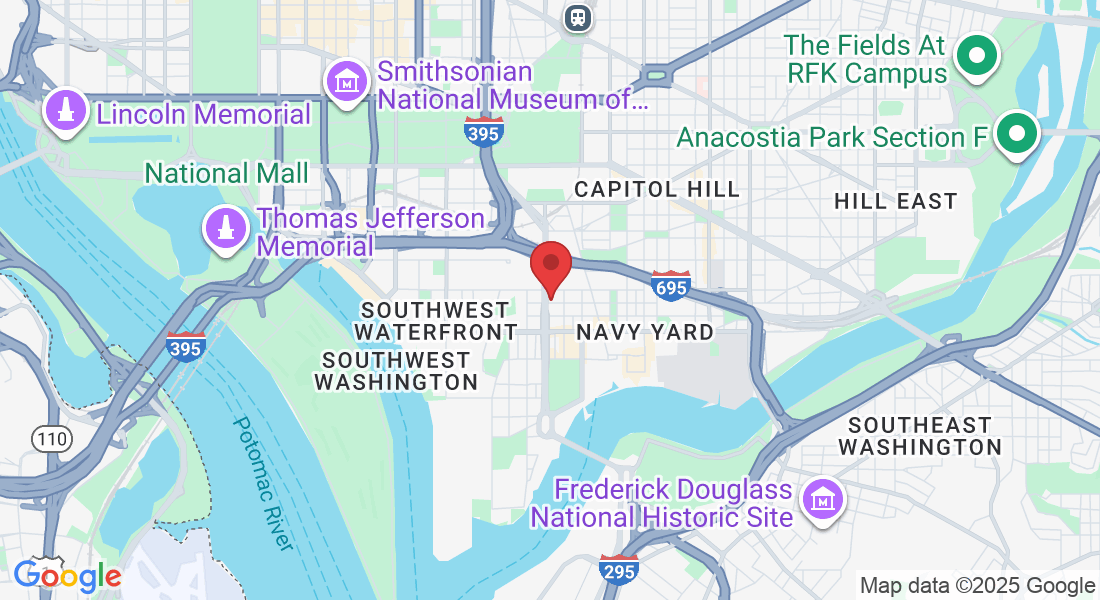

Bridge Fund Development Group LP is a Delaware limited partnership. For licensing details or regulatory inquiries, please contact us at [email protected] or by mail at10 K Street SE, Suite 1012 Washington, DC 20003.